Introduction

A recent judgment by the Delhi High Court has brought welcome clarity to the valuation of unquoted equity shares—a topic that often puzzles startups, investors, and professional valuers. In dismissing the Revenue’s appeal, the HC upheld the Income Tax Appellate Tribunal’s (ITAT) endorsement of the Discounted Cash Flow (DCF) method under Rule 11UA(2) of the Income Tax Rules. This landmark decision reaffirms that assessees have the autonomy to choose DCF for fair market value (FMV) determination when issuing equity shares. Let's explore the ruling, its implications, and what it means for stakeholders—all in clear, beginner-friendly language.

🧩 Understanding the Context: Rule 11UA(2)

What is Rule 11UA(2)?

-

Under Section 56(2)(viib) of the Income Tax Act, when unlisted companies issue shares above face value, the premium (issue price minus FMV) is taxable as "Income from other sources."

-

Rule 11UA(2) allows assessees to determine FMV using either:

-

Net Asset Value (NAV) based on balance-sheet figures, or

-

DCF method via a valuation report by a merchant banker or accountant

-

Why it matters

This flexibility is crucial: companies can opt for a forward-looking DCF method when NAV undervalues future prospects—a common scenario in high-growth or tech firms.

🔍 The Case: SAFL Share Valuation Dispute

Quick case summary

-

The assessee held a stake in South Asia FM Ltd. (SAFL, owner of Red FM).

-

For FY 2015–16, new shares were issued at ₹20 each.

-

A Chartered Accountant valued SAFL at ₹519 cr using DCF and ₹2,772 per share for the assessee.

-

The Assessing Officer (AO) rejected this valuation, preferring book value (negative), leading to a ₹30.37 cr addition as income under Section 56(2)(viib)

Judgment Highlights

-

ITAT accepted the DCF report—no flaws in data or methodology.

-

Delhi HC dismissed Revenue’s appeal, stating:

-

The AO had computed NAV via Rule 11UA but found it negative.

-

Since DCF value was higher and legally supported, it must prevail.

-

The AO cannot reject DCF and impose NAV-based valuation when the former is valid

-

✅ Key Takeaways for Businesses

1. Assessee's discretion

Under Rule 11UA(2), companies may choose DCF over NAV, especially when future cash flows are strong

2. AO can't switch methods

Even if an AO doubts a DCF report, he cannot substitute NAV valuation; can only challenge the DCF data or process .

3. Valuation standards

-

DCF-based FMV must be prepared by a merchant banker or registered accountant

-

Book-value NAV can be done internally without external certification—but may yield low FMV for high-growth firms.

4. Compliance and audits

-

DCF involves projections and assumptions—must be well-documented and realistic.

-

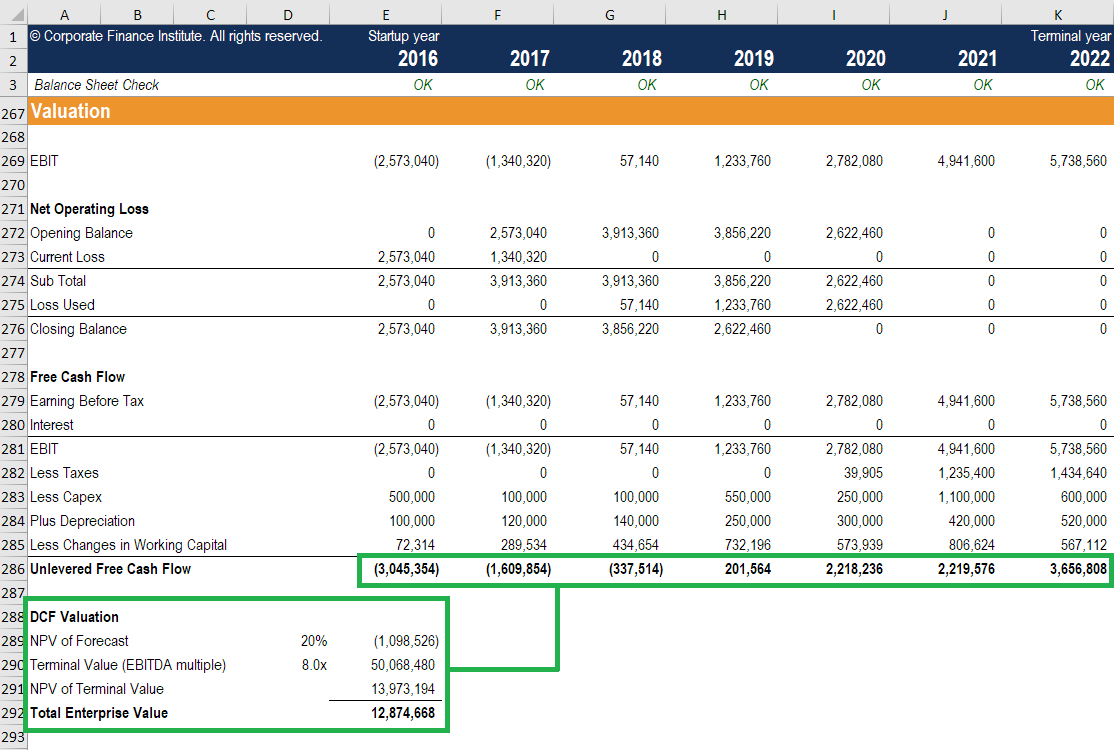

Common parameters:

-

Projected Free Cash Flows (5–10 years)

-

Terminal value and discount rate (typically WACC)

-

Sensitivity analysis (best/worst-case scenarios)

-

☑️ Practical Tips for Executives & Startups

-

Choose method early: Analyze pros/cons; DCF suits growth-driven firms.

-

Engage a qualified valuer: Merchant bankers with valuation credentials.

-

Anchor assumptions: Use historical data, market trends, explicit growth rate rationale.

-

Run NAV check: Compare with NAV—expect DCF > NAV, especially if NAV is depressed.

-

Prepare backup: In case AO raises questions, maintain full documentation and third-party expert report.

-

Get updated regularly: Valuation reports should be current—safe harbor validity (often 90 days).

📊 Comparison Table: NAV vs DCF

| Feature | NAV Method | DCF Method |

|---|---|---|

| Supported by rule | Yes (11UA(2)(a)) | Yes (11UA(2)(b)) |

| Requires external report | No | Yes (merchant banker/accountant) |

| Based on historical data | Yes (balance sheet) | No (future projections) |

| Best for | Asset-heavy, stable firms | High-growth, intangible-heavy companies |

| FMV likely | Lower, static | Higher, dynamic |

| Auditor scrutiny | Light | Medium-heavy (assumption justification) |

| AO discretion | Minimal | Cannot switch method |

📌 Real-World Scenario: Tech Startup

Consider a SaaS company:

-

NAV: ₹5 per share—low due to high development costs.

-

DCF projected at ₹120/share—based on future subscriptions and renewals.

-

In issuance: premium of ₹115/share taxed under section 56(2)(viib).

-

NAV undervalues, but under DCF, tax triggers a ₹115 premium; NAV would yield a ₹0 premium—making DCF mandatory to justify issuance.

🔚 Conclusion

The Delhi HC’s decision is a big win for companies seeking fair valuation of unquoted equity. It affirms:

-

Assessees have choice between NAV and DCF under Rule 11UA(2)

-

AO must respect valid DCF valuations

-

High-growth firms benefit from this clarity and flexibility

By choosing DCF with robust documentation and expert validation, companies can better align share price with intrinsic value—reducing tax and litigation risk.

❓ FAQs

1. Can any chartered accountant do DCF valuation?

No. Under Rule 11UA(2b), only merchant bankers or registered valuers may conduct DCF valuation

2. What if both NAV and DCF are used?

Rely on the higher FMV. If NAV is negative or lower, and DCF is accepted, that will govern FMV.

3. How to choose discount rate in DCF?

Typically use WACC or industry benchmarks. Sensitivity testing is recommended.

4. How frequently should valuation be updated?

Reports are typically valid for 90 days. Matter of safe harbor—updates may be needed depending on issuance timing.

5. What happens if AO rejects DCF report?

AO can question data/assumptions. But cannot switch to NAV. If DCF method is valid, AO must accept or make adjustments—not alter method

✨ Call to Action

Need help with share valuation under Rule 11UA(2) or preparing a robust, defendable DCF report? Manika FinTax Solutions offers professional support:

-

Expert DCF valuations

-

Merchant banker-certified reports

-

Step-by-step guidance through issuance process

Contact us today for paid filing & compliance assistance—let’s make your valuation seamless and tax-smart!

Post a Comment

0Comments