📣 Introduction: Why U.S. Tariffs Still Matter

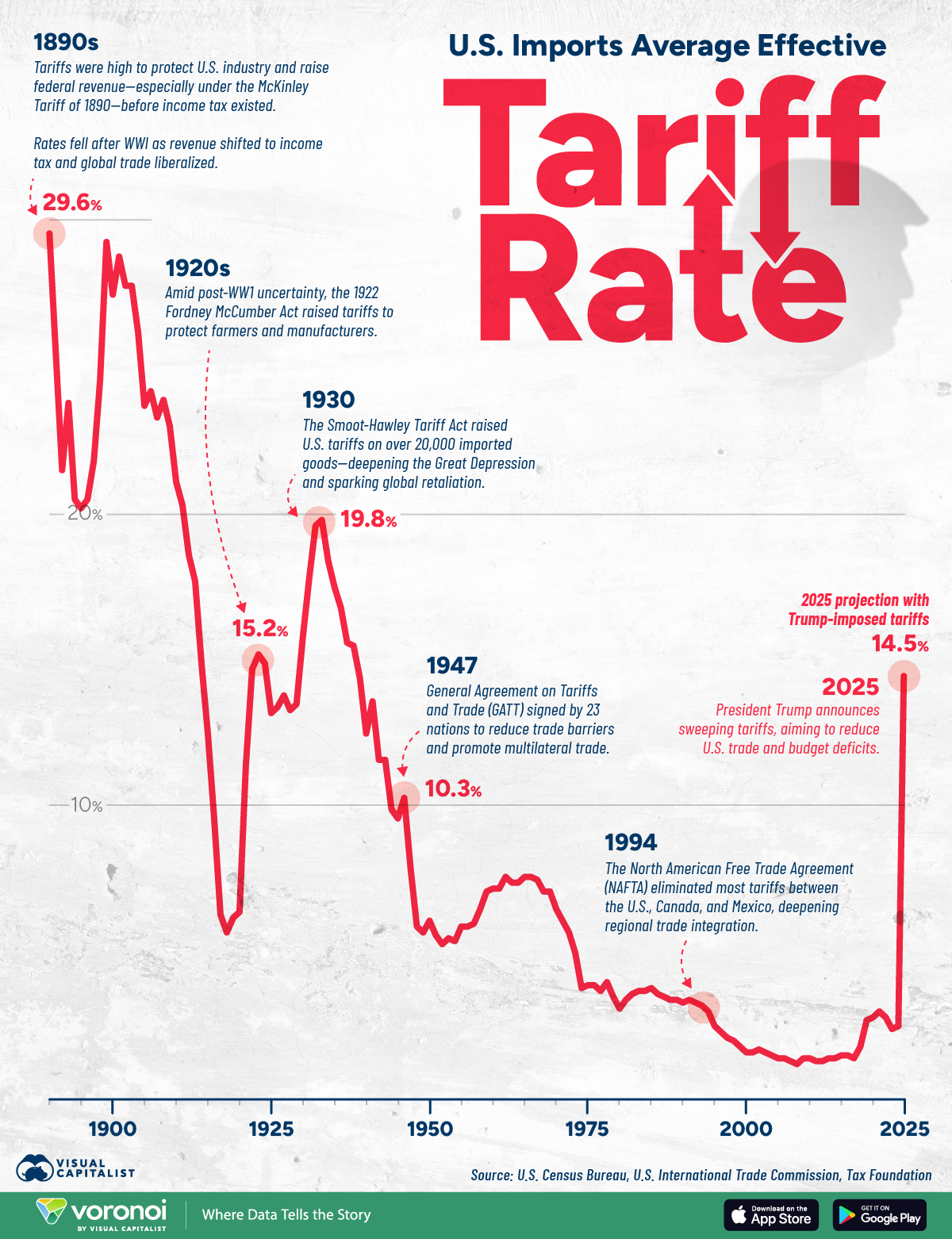

Tariffs—taxes on imports—have shaped America’s economic journey since its founding. From funding the new government in the 1780s to fueling industrial growth in the 19th century, and sparking trade wars in 2025, U.S. tariff policy has continuously impacted revenue, businesses, consumers, and international relations. For Manika FinTax Solutions readers, understanding this history is key to grasping today’s economic dynamics and what they mean for taxes, costs, and strategic planning.

1. Early Days: Tariffs as Foundation (1789–1815)

-

Tariff Act of 1789

The very first major U.S. law after the Constitution, imposing ~5% duty to finance the government and debt repayment -

Tariff of 1816 ("Dallas Tariff")

Introduced protective duties (~20%) post-War of 1812 to encourage local manufacturing, blending revenue needs with national security

2. Industrial Age: Rising Protectionism (1820–1913)

| Period | Notable Tariffs | Average Duty | Purpose |

|---|---|---|---|

| 1828 – "Tariff of Abominations" | Up to 50% | ~40% | Protect northern industry; triggered Nullification Crisis |

| 1842 – Black Tariff | ~40% | Specific duties | Reintroduced protectionism under Whigs |

| 1897 – Dingley Act | ~47% in Year 1 | ~50% average | Highest tariffs to benefit heavy industries under McKinley |

Key takeaway: From 1790 to 1913, tariffs averaged 20–60%, funding the government and shielding domestic industries .

3. Interwar Period: Peaks & Backlashes (1916–1934)

-

Fordney–McCumber Tariff (1922)

Reinstated high tariff levels after WWI, provoking retaliations and sparking trade tensions -

Smoot–Hawley Tariff (1930)

The notorious high-point (~60% duties). Economists largely agree it worsened the Great Depression—exports plunged as trading partners retaliated

4. Post-WWII Shift: Toward Free Trade (1934–2000)

-

Reciprocal Trade Agreements Act (1934)

Transferred tariff-setting powers to the president, enabling bilateral trade deals. -

GATT (1947) & WTO (1995)

Multilateral agreements implementing “Most Favored Nation” (MFN) principles, pushing average U.S. tariffs below 5% -

Latest estimates

Applied average MFN tariff: ~1.6% (2016), comparable with EU and Japan

5. Return of Protectionism: Tariffs Resurge in 2025

-

Under the second Trump administration:

-

Tariff rate rose from ~2.5% in January to ~27% by April 2025—the highest in over a century—later moderating to ~15.6%

-

A sweeping “reciprocal tariff” policy: 10% on all imports, scaling to 50% for targeted nations, plus 25% tariffs on autos, steel, aluminum, and Canada’s goods

-

As of mid-June 2025, aluminum tariffs doubled from 25% to 50%, prompting concerns over domestic competitiveness and industrial energy limits

-

6. Why It Matters in 2025: Real-World Impacts

Inflation & Consumer Costs

-

Tariffs function like a tax on imported goods; firms often pass these costs to consumers—expected inflation impact was small initially but may increase as stocks deplete .

-

Retail sales in May 2025 dropped 0.9%, with car sales plunging 3.5% after consumers preemptively purchased ahead of tariff increases

Business Disruption & Supply Chains

-

Small companies are redirecting resources from innovation to tariff compliance, delaying product launches, and restructuring supply chains

-

Educational toy-makers Learning Resources and hand2mind have brought their case to the U.S. Supreme Court, arguing the tariffs exceed presidential authority under IEEPA

Economy & Trade Relations

-

Economists warn of recession risks, suppressed economic growth, retaliatory tariffs (Canada, Mexico, China), and weakened exports due to currency effects

-

Mixed resilience: May 2025 jobs report showed continued job growth +139k, inflation at 2.4%—but underlying economic uncertainty persists .

7. Practical Tips for Businesses & Taxpayers

-

Review supply chains: Identify exposure to recently tariffed categories like steel, aluminum, autos.

-

Plan for cost pass-through: Expect potential price increases; assess impact on margins.

-

Explore alternative suppliers: Near-shoring and domestic vendors might mitigate rising duties.

-

Stay updated on exclusions: Some agreements exempt Canadian/Mexican-origin CUSMA goods, or allow tariff exclusions—monitor and apply.

-

Engage legal counsel: Especially if tariffs seem unlawfully imposed—consider legal recourse like Supreme Court petitions.

-

Monitor trade legislation: Congress may act to adjust or override tariff measures—be ready for policy shifts.

8. ✅ Conclusion: Learning from the Past, Navigating the Present

The history of U.S. tariffs reveals a pendulum between revenue/protection goals and free-trade ideals. Today’s resurgence underscores how rising duties ripple through prices, trade dynamics, and business strategies. For clients and stakeholders of Manika FinTax Solutions, recognizing these patterns is vital. By integrating tariff-awareness into tax and finance planning, you can better manage risks and adapt to global economic shifts.

FAQs (for SEO & Clarity)

Q1: What is the purpose of a tariff?

A tariff is a tax on imported goods, historically used for revenue, protecting domestic industries, or negotiating trade leverage.

Q2: Did tariffs fund the early U.S. government?

Yes—especially from 1798–1913, when 50–90% of federal revenue came from tariffs .

Q3: Why is the Smoot–Hawley Tariff infamous?

Enacted in 1930, it raised duties to ~60% and is widely blamed for worsening the Great Depression due to global trade retaliation .

Q4: What is an MFN tariff?

MFN (Most Favored Nation) tariff is a standard rate applied equally to all WTO members, ensuring non-discrimination

Q5: How do modern businesses handle 2025 tariffs?

They’re shifting supply chains, restructuring costs, seeking exclusions, and some are pursuing legal challenges .

📞 Need Help with Tax Filings Amid Tariff Changes?

Manika FinTax Solutions is here to help you navigate the evolving landscape: integrating tariff considerations into tax planning, maximizing deductions, and ensuring compliance. Contact us today for expert support with your paid filings and financial strategies!

Keywords

U.S. tariffs history, Tariff Act 1789, Smoot–Hawley Tariff, 2025 tariffs impact, trade policy, tariff inflation, supply chain disruption, customs duties, reciprocal tariffs, tariff planning.

Post a Comment

0Comments