📌 Introduction: A New Era in Tax Management

In today’s digital-first world, managing tax data manually is a recipe for disaster. Slow processing, errors, outdated systems, and rising regulatory scrutiny make effective tax data management non-negotiable. Your finance team at Manika FinTax Solutions can no longer rely on scattered spreadsheets or disjointed systems. It’s time to embrace modern data practices that offer compliance, transparency, and strategic insights.

This article dives into:

-

The forces reshaping tax data demands

-

Core benefits and challenges

-

Practical best practices

-

Examples and stats from top firms

-

Easy-to-follow action plans

-

FAQs to boost SEO

Let’s get started!

🔍 Part 1: Why the Pressure on Tax Data Is Escalating

Several trends are converging to make tax data management mission-critical:

-

Regulatory Complexity

Global tax regimes—OECD Pillar Two, e-invoicing, incoming digital audits—mean finance teams must track increasingly granular data -

Digital Tax Authorities

Tax agencies demand real-time, transaction-level data, replacing periodic returns with continuous oversight . -

ERP & Cloud Disruption

Organizations now have vast pools of structured and unstructured tax-relevant data that need integration -

Remote Work & Global Employees

Teams working across borders intensify the need for precise geolocation and payroll tax records . -

Business Evolution

New offerings (e.g., subscriptions, digital services) bring fresh tax obligations and data needs

As Deloitte sums up, “tax departments are under increasing pressure to deliver real‑time, accurate, transaction‑level data” .

🎯 Part 2: The Benefits of Effective Tax Data Management

-

Compliance & Audit Readiness

Quick retrieval of audit trails and tax returns is essential—failed access can mean penalties -

Data Accuracy & Integrity

A consistent, governed data pipeline reduces manual error and enforces quality protocols -

Operational Efficiency

Automation enables finance teams to trace transactions to tax data instantly, reducing repetitive tasks. -

Insightful Decision-Making

Tax data fuels strategic scenarios—transfers, tariffs, tax credits—supporting smarter planning . -

Enhanced Transparency & Trust

Centralized, auditable data builds confidence among stakeholders and regulatory bodies. -

Real-Time Reporting

Continuous access helps spot anomalies early and supports fast response to data requests

⚠️ Part 3: Common Challenges in Tax Data Management

-

Fragmented Systems: Scattered silos make end-to-end data tracing nearly impossible .

-

Data Volume: ERP and ERP-adjacent data can overwhelm outdated infrastructure

-

Regulatory Changeability: Keeping up with shifting global tax rules demands agility

-

Lack of Expertise: Tax teams often lack data science or governance skills

-

Governance Gaps: Without robust stewardship, data quality suffers

🛠️ Part 4: Proven Strategies & Best Practices

1. Define a Tax Data Roadmap

-

Identify current and future data obligations

-

Map all sources, owners, and uses for transparency

2. Centralize & Integrate

-

Build a tax data warehouse or lake connecting ERP to tax systems

-

Merge structured and unstructured formats for full visibility

3. Automate Validation & Cleansing

-

Use tools to check for outliers, misclassifications, and missing data early

4. Assign Data Stewardship

-

Define roles (data stewards, owners, governance teams) with clear responsibilities

5. Implement Security & Classification

-

Use classification labels (e.g., confidential, public) and encrypted storage

6. Acquire Tax-Savvy Data Talent

-

Hire/train professionals fluent in tax + analytics—they’re critical for future compliance

7. Build in Adaptability

-

Work flexibly to swiftly adjust for new tax types, regions, or models

8. Maintain Governance Frameworks

-

Adopt policies ensuring consistent data practices; audit periodically

📝 Part 5: Real-World Success & Statistics

-

Deloitte Insights: 57% of finance leaders are building data lakes, 46% using data hubs to handle ever-growing volume

-

Survey Highlight: 24% plan tax-specific ERP deployments; only 37% currently utilize tools to monitor global tax updates

-

KPMG Case Study: Adoption of tax-quality frameworks boosted accuracy and cut processing time significantly .

-

Thomson Reuters Insight: Centralizing and automating drives agility, accuracy, and compliance .

📊 Part 6: Sample Table – Tax Data Best Practices Overview

| Best Practice | Risk Addressed | Benefit |

|---|---|---|

| Data roadmap mapping | Data gaps / fragmented ownership | Clarity and unified responsibility |

| Tax-centric data warehouse | Siloed systems / manual consolidation | Centralized, searchable data repository |

| Automated validation | Human errors / inconsistent data | Higher accuracy, early detection |

| Data stewardship model | Lack of oversight | Consistent data definitions and quality |

| Classification/security layers | Data breaches / non-compliance | Protected data and regulatory adherence |

| Train tax-data hybrid staff | Skills gap in analytics | Strategic insights and process efficiency |

| Governance & periodic audits | Compliance drift over time | Maintains long-term data health |

🧭 Part 7: Practical Tips to Begin Today

-

Assess Your Tax Data Landscape: List sources, users, pain points.

-

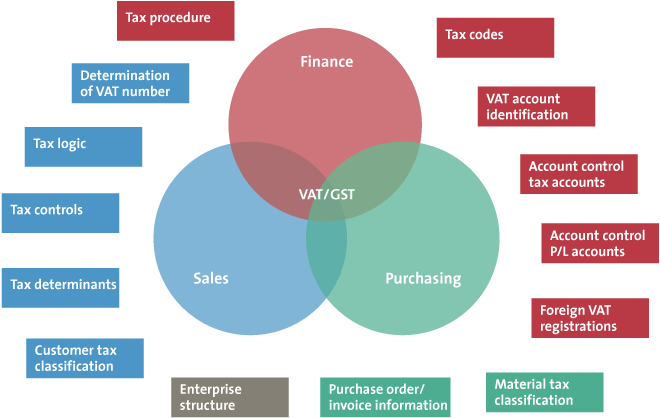

Start Small: Select a single-use case (e.g. VAT return) to pilot data flows.

-

Choose the Tools: Leverage existing ERP, cloud, and validation tools.

-

Define Ownership: Appoint clear data stewards and establish protocols.

-

Train Your Team: Combine tax and data fluency via workshops or courses.

-

Iterate Fast: Scale the pilot case-by-case, adding compliance layers.

-

Review Continuously: Audit data quality and refine processes annually.

✅ Conclusion

For finance functions striving to keep up, effective tax data management is essential—not optional. The benefits are clear: improved compliance, speed, accuracy, insights, and stakeholder trust. Challenges abound—but so do solutions. With thoughtful planning, governance, and technology adoption, your team can transform how tax data is handled.

Start small, build fast, govern well—and you’ll transform your finance function into a strategic tax center.

❓ FAQs

Q1: What is tax data management?

A: It’s the structured process of collecting, storing, validating, analyzing, and protecting tax-relevant data—from ERP transactions and payroll to third-party invoices—for compliance and insight generation

Q2: Why is automation essential?

A: Manual methods are slow and error-prone. Automating data flows ensures accuracy, delivers real-time reports, and boosts audit readiness .

Q3: What is a tax data warehouse or data lake?

A: These are centralized repositories (structured and unstructured) that consolidate all sources—essential for end-to-end visibility and analytics .

Q4: What roles manage tax data?

A: Data stewards, owners, and a governance team ensure accuracy, classification, metadata consistency, and responsible usage .

Q5: What’s a quick starter project?

A: Begin with a VAT or GST return dataset. Map its source, validate it, and automate the delivery—then expand its scope gradually.

📞 Call to Action

Are you ready to streamline your tax processes? Contact Manika FinTax Solutions today for expert paid filing support, tailored data management strategies, and on-time compliance. Let us make tax simple and strategic for your business!

Keywords: tax data management, automated tax reporting, tax data governance, tax compliance tools, ERP tax integration, data stewardship, tax warehouse, finance tech.

Post a Comment

0Comments