📋 What You’ll Learn

-

What is a Form 10‑K?

-

Why it matters for investors and businesses

-

Core sections of the 10‑K explained

-

Filing deadlines & regulatory background

-

Real-world examples

-

Key statistics and noteworthy tips

-

How to read a 10‑K effectively

-

Practical takeaways for users

-

FAQs

-

Strong conclusion & CTA

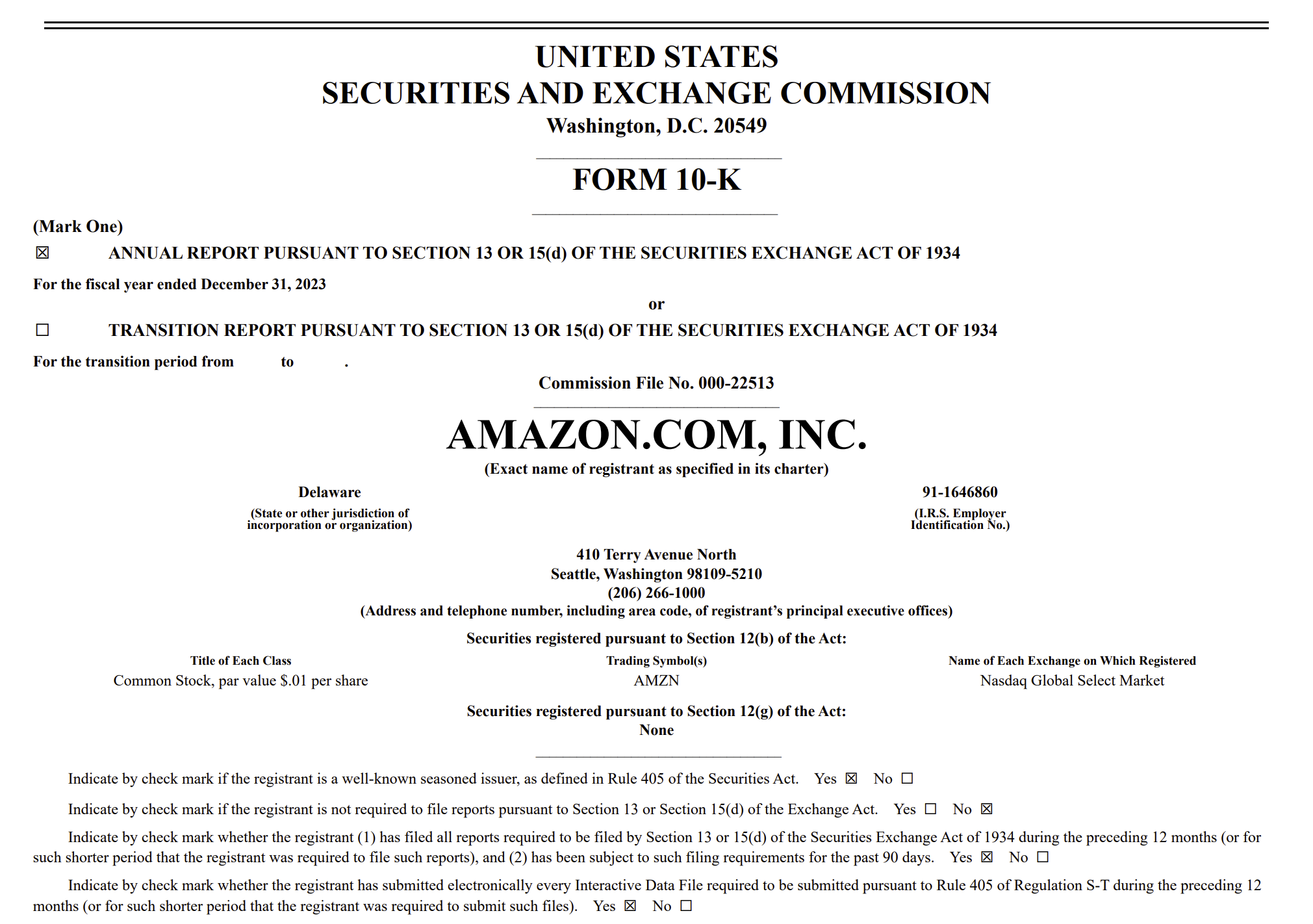

1. What is a Form 10‑K?

A Form 10‑K is an annual report publicly traded U.S. companies must file with the SEC. It provides a comprehensive breakdown of a company's financial performance, business model, risks, management narrative, and audited financial statements

🔑 Key highlights include:

-

Business overview & history

-

Risk factors

-

Management’s Discussion & Analysis (MD&A)

-

Detailed financial statements

-

Executive finance certifications

2. Why Does the 10‑K Matter?

-

Investor confidence: Investors rely on it to make informed decisions.

-

Regulatory compliance: It's mandatory under the Securities Exchange Act .

-

Transparency: It's more detailed and formal than a marketing-style annual report

-

Risk assessment: Helps uncover hidden liabilities or legal issues .

⚠️ Noncompliance can result in fines, penalties, and dropped trust .

3. Key Sections of the 10‑K

Understanding the parts makes reading it far easier:

Part I

-

Item 1 – Business: Company’s operations, subsidiaries, markets

-

Item 1A – Risk Factors: The top risks listed by importance

-

Item 1B – Unresolved Staff Comments: Flags from the SEC

-

Item 2 – Properties: Physical assets owned

-

Item 3 – Legal Proceedings: Major lawsuits or regulatory actions

-

Item 4 – Mine Safety (if applicable)

Part II

7. Item 5 – Market & Ownership: Stock stats, dividends, repurchases

8. Item 6 – Selected Financial Data: 5-year snapshot

9. Item 7 – MD&A: Management explains performance

10. Item 7A – Market Risks: e.g., interest rates, currency exposure

11. Item 8 – Audited Financials: Balance sheet, cash flow, income, auditor opinion

12. Item 9-9B: Accounting changes, internal controls

Part III

13. Governance: Directors, execs, compensation, ownership

Part IV

14. Item 15: Exhibits, schedules, signatures

4. Filing Deadlines & Regulatory Background

Deadlines depend on company size under Regulation S‑K :

| Filer Type | Deadline After FY-End |

|---|---|

| Large accelerated (> $700M float) | 60 days |

| Accelerated ($75–700M) | 75 days |

| Non-accelerated (< $75M) | 90 days |

Filed via EDGAR, verified by CEO/CFO signature

5. Real-World Examples

Example 1: Company X

In Item 1A, Company X warns that 30% of suppliers are overseas—highlighting supply chain risk.

Example 2: Company Y

MD&A reveals rising energy costs as a major factor cutting profit margins YoY—useful intel for investors comparing peers.

6. Statistics & Practical Tips

-

📝 90% of investors use the 10‑K for due diligence

-

🧮 Typical 10‑K has 150–300 pages, heavy on financial tables

-

Legal and footnotes often reveal hidden debt, lease obligations, and accounting choices

-

Footnotes help compare GAAP vs. actual accounting methods

🧠 Tip: Start with Risk Factors, then MD&A, then financials and footnotes.

7. How to Effectively Read a 10‑K

-

Quick scan: Cover, signature, table of contents

-

Risks: What could go wrong?

-

MD&A: Understand the story behind numbers

-

Financials: Compare trends—revenue, profit, cash flow

-

Footnotes: Focus on debt, leases, legal liabilities

-

Governance: Execs and compensation

-

Glossary: Understand technical terms

8. Practical Takeaways for You

-

Ideal for investors, analysts, and trend analysts

-

Helps spot red flags like rising debt, shrinking margins

-

Adds rigor to comparing competitors

-

Improves strategic alignment by showing stated business goals

-

Non-finance readers can still gain from the overview and risk narratives

9. FAQs

Q1: How does a 10‑K differ from an annual report?

10‑Ks are long, formal SEC filings. Annual reports tend to be design-heavy and promotional

Q2: Where to find a company’s 10‑K?

Check the Investor Relations section or use the SEC’s EDGAR search.

Q3: Can I rely on only the 10‑K to invest?

It's great for fundamentals but pair it with current news, 10‑Q, and 8‑K filings.

Q4: What if I find technical terms confusing?

Use glossaries, SEC’s guides, or tools like ChatGPT to decode jargon.

Q5: What if a company delays filing?

Expect penalties, declines in investor trust, or stock price drops.

10. Conclusion

Form 10‑K is your annual roadmap to a public company’s strategy, financial health, and risks. Though dense, it’s invaluable for anyone serious about investing or corporate analysis. With the right approach—focus, structure, and patience—you can turn it into a powerful decision-making tool.

Ready for Hands-On Help?

Unlock early benefits by grabbing 10‑Ks from top companies. Compare them, note differences, and sharpen your analysis.

✅ Call to Action

Unlock expert help with preparing and filing your own reports. Reach out to Manika Fintax Solutions for professional paid support!

Keywords included: "Form 10‑K", "10‑K report", "how to read 10‑K", "10‑K filing deadline", "risk factors", "MD&A", "SEC 10‑K", "10‑K examples", "financial statements", "10‑K guide".

Post a Comment

0Comments